Instant access to tips and wages¹ ²

Now introducing Toast Pay Card and PayOut – a free3 and flexible way to pay your staff.

Financial flexibility for your staff

Eliminate trips to the bank for cash

Streamline your tip-out process with end-of-shift tip-outs to the Toast Pay Card.1 Plus, replace paper checks and get rid of the paper and shipping costs.

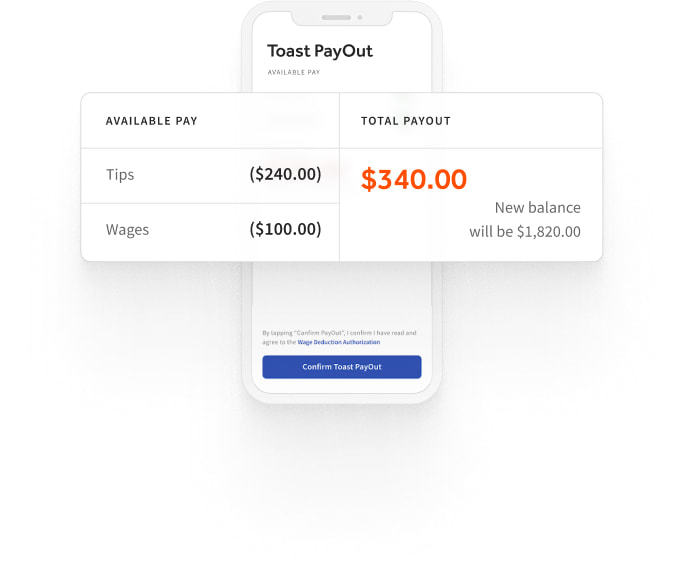

Access tips and wages between paydays1

Restaurants that offer early access to pay can increase their employees’ financial stability, boost engagement, and improve retention.

Free for you and your team3

No additional cost to you and your staff, and no third-party fees when used at over 37,000 ATMs within the MoneyPass® Network. The Toast PayOut feature does not add additional steps to your payroll process. Toast PayOuts are funded by a 0% line of credit provided to your restaurant.

Click here to learn more about the line of credit.

*MoneyPass is a registered trademark of Fiserv, Inc.

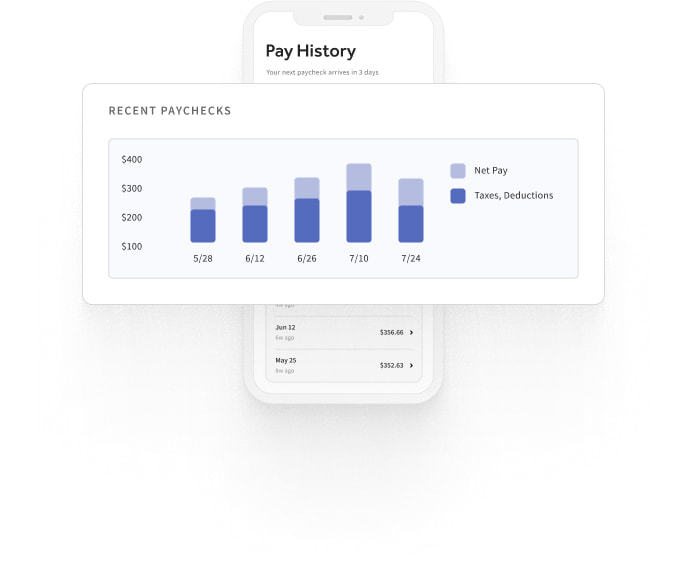

Get paid after every shift1

Employer FAQ

We’re working hard to offer the product in all states. Today, Toast Pay Card and PayOut is available in all states except:

CA, HI, MS, NH, NV, NY, NC, ND, SD, TN, UT, VT. Other requirements may apply.

If you are in a state that is not currently eligible, keep an eye out on this page for when your state becomes eligible.

If you have restaurants in multiple states, they all must be in states that are currently eligible.

States may have laws related to offering pay cards as a form of payroll disbursement and earned wage advances. Employers should become familiar with any laws applicable to them so that they can comply.

Employee FAQ

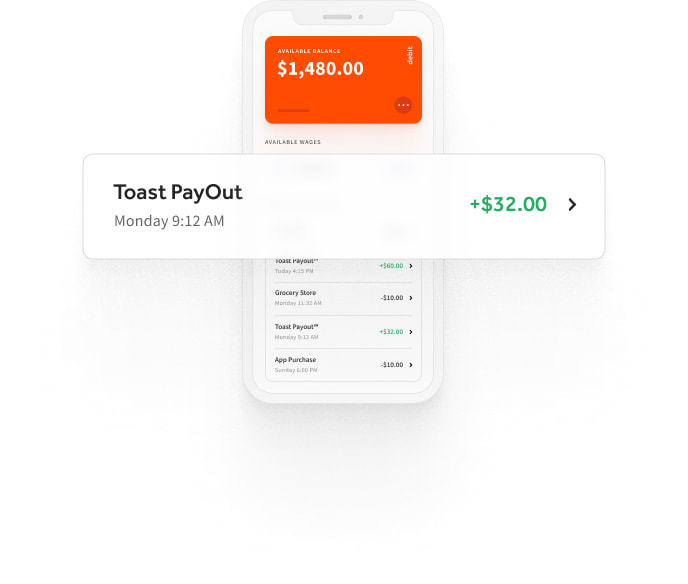

A prepaid Mastercard debit card that can give you access to a portion of tips and wages without a bank account. It is an alternative to paper checks or direct deposit.

Get started today

Get a customized walkthrough of Toast catered to your restaurant's unique needs.

Already use Toast at your restaurant? Log in to Toast.

By requesting a demo, you agree to receive automated text messages from Toast. We’ll handle your info according to our privacy statement.

Toast Pay Cards are issued by Sutton Bank, Member FDIC, pursuant to license by Mastercard®. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated. Toast PayOuts are funded by a 0% line of credit issued to employers by Toast, Inc. or WebBank, as set forth in the employer’s Credit Agreement. Toast and WebBank reserve the right to change or discontinue this program at any time.

- Access is typically available instantly after the employee's shift; however, if restaurants tip pool using Toast Tips Manager, Toast PayOuts of tips are available after the tip pool is approved and sent to Toast Payroll, typically the next calendar day.

- Availability of Toast PayOuts varies by employer. Visit the MyToast app to see if your employer offers Toast PayOuts. Toast PayOuts may be limited to a portion of pay to help account for estimated taxes, withholdings, and deductions. Tip PayOuts are not available at restaurants that tip pool without using Toast Tips Manager. Employees must receive wages via their Toast Pay Card in order to access Toast PayOuts. Tips will be paid to employees on their Toast Pay Card as though they were receiving them in cash. Wages will be advanced by employers during the pay period and deducted from their total wages paid to them on payday.

- Toast Pay Cards do not have any associated ATM withdrawal or other fees; however, third-party ATM operators may charge a fee unless the cardholder uses an ATM within the MoneyPass® Network, and third-party financial institutions may charge a fee for over-the-counter withdrawals unless the institution is a Mastercard® member bank. MoneyPass is a registered trademark of Fiserv, Inc.

- Fees charged by the receiving financial institution are uncommon but may apply. Employees will receive 2 free transfers per calendar month. It is not possible to exceed that limit, even for a fee. Employees cannot schedule transfers for future dates. There is a limit of $2,500 per transaction, $5,000 per day, and $5,500 per month. Limits are subject to change. Employees should see their Cardholder Agreement for details.