A Guide to Bar Financing and Loans

Whether you’re opening a new bar, or expanding your concept, you’re going to need capital to make it all happen.

Victor TaiwoAuthor

Restaurant Opening Calculator

This calculator lays out some of the fundamental financial costs of opening a restaurant, so you can start planning and bring your dream restaurant to life.

Get free downloadOpening and running a bar is a tough business. It takes time and energy to develop and build your concept, and it also can be expensive, which means every would-be restaurant owner needs to know how to get affordable bar financing.

But getting started with restaurant financing can be tricky, especially if you’ve never taken out a business loan before. Today, let’s break down everything you need to know about bar financing in detail.

Why Do You Need Financing for a Bar?

More specifically, you need financing for your bar so you can:

Open the restaurant up in time for your projected business goals

Purchase all the supplies and materials you need to run a restaurant or bar successfully

Hire enough employees to accommodate increased demand

Purchase or rent an ideal bar location

On top of that list, running a bar means accounting for ongoing costs, like supplies, silverware, changes in employees, insurance costs, and more. In short: bar financing is the best way to pay for everything your bar needs to run successfully. For many people, it’s also the only way to pay for a new bar – unless you have several hundred thousand dollars in cash waiting around.

Restaurant Opening Calculator

This calculator lays out some of the fundamental financial costs of opening a restaurant, so you can start planning and bring your dream restaurant to life.

Determine the Right Business Loan For You

There are many different sources of bar financing. Some sources may be more or less appropriate for your bar depending on your needs, what your payroll costs are, how much you need to secure equipment or purchase property, and so on. Here are some of the best bar financing sources you should consider.

SBA loans

SBA loans are loans from the US Small Business Administration. These loans usually enjoy low interest rates, generous term lengths, and other financial advantages for small business owners just like yourself.

The loans don’t come from the US government, of course. Instead, they come from lenders that are partnered with the SBA, so you know that the lenders are trustworthy.

SBA loans are great for purchasing property, paying for ongoing costs, and for purchasing anything else you may need to open or run a bar.

Equipment loans

On the other hand, maybe you need funding for one or two specific purchases. Say that you lost a lot of silverware or your refrigerator went kaput, so you need a replacement ASAP.

In that case, an equipment loan may be the best choice. Equipment loans are accessible and affordable and are only meant to be spent on specific equipment needs. Furthermore, most equipment loans accept some form of collateral if you don’t have high credit, allowing bar owners without stellar credit scores to still secure the financing they need to keep their businesses open.

Microloans

Microloans are exactly what they sound like: very small loans offered by a variety of different lenders. Microloans are ideal if you have a short-term cost coming up and can’t afford it out-of-pocket, but will then repay the microloan at your earliest opportunity.

These loans can be effective, but be sure to read your repayment terms carefully. As with any loan, don’t take out a microloan with an exorbitant interest rate, as you may end up paying more than you can afford in the long run.

Crowdfunding

If you have a big customer base, you might be able to finance your bar through crowdfunding. Crowdfunding involves accepting donations from the public or from a wide network of acquaintances and friends using platforms like GoFundMe. Note that crowdfunding is usually only ideal for opening a bar for the first time, repairing your bar after a major disaster, or for other big, one-time purchases.

Business lines of credit

A business line of credit is similar to a credit card – it gives you a set credit limit, up to which you can spend for almost any business purpose. You have to pay off whatever balance is on the business line of credit, typically with a minimum amount each month.

Business lines of credit can be excellent for ongoing costs and supply purchases. Just spend what you need each month, then pay it off at the end of the month when you collect your profits from the month’s patrons.

Business credit cards

Similarly, business credit cards are ideal for buying ongoing supplies, paying for employee costs, and other recurring expenses that you’ll need to keep your bar operational. Business credit cards vary heavily in terms of their interest rates, fees, and credit limits.

Typically, the business credit cards and lines of credit with the lowest interest rates and most favorable terms are available to bar owners and businesses with the highest personal and business credit scores. Find out your personal credit score and your bar’s business credit score ahead of time to get an idea of where you fall so that you can clear up any issues before applying.

Note that both business lines of credit and business credit cards aren’t ideal for big, one-time purchases, like buying a new bar property.

10 Recommended Bar Financing Options to Consider

Which are the most popular restaurant financing options?

It seems as though there are equally as many business financing options as there are reasons to apply for financing. Some financing options are perfect for short-term projects, while others are better suited for long-term business goals.

It’s worth noting that when business owners typically think of business financing, they assume all of their options are loans or they’re limited to funding they can receive from a brick-and-mortar bank. Not true! Merchant cash advances, lines of credit, purchase order financing, and invoice financing are all solid restaurant financing options that don’t fall within the loan bucket. Additionally, alternative loan lenders offer a little more leniency and flexibility around eligibility, qualifications, and the pay-back process than brick-and-mortar banks.

Within the wide net of restaurant financing options, these are the ones restaurateurs typically lean on when applying for restaurant financing:

- A term loan from a “brick and mortar” bank

- An alternative loan

- A small business association loan, also known as an SBA Loan

- A merchant cash advance

- A business line of credit

- Funds or equity from friends and family

- Equipment financing

- Crowdfunding

To help you decide which business financing option is the best choice for you, your restaurant, and your goals, let’s dive into the characteristics of 10 popular restaurant financing options, ranging from restaurant loans to business lines of credit.

1) Traditional “Brick-and-Mortar” Bank Term Loans

Brick-and-mortar bank loans vary from bank to bank and business to business. Let’s walk through some of the pros, cons, and general characteristics of traditional brick-and-mortar bank term loans.

A “brick-and-mortar” bank loan oftentimes:

- Has a lengthy application process. The average brick-and-mortar term bank loan application process tends to span 14-60 days. This could be a good option for you if you have a flexible timeline for your project or if you start looking for funding well in advance of when you need to have cash on hand.

- Requires you to put up collateral to back the loan. This could be business or personal collateral. 31% of small business owners with debt use personal assets to secure debt, while 49% of small business owners use business assets (like real estate if you own your physical location, equipment, etc.) to back their loan. Putting up collateral, or using a personal guarantee, can sometimes reduce your cost of funding, and is oftentimes required regardless of cost. You need to decide what your risk tolerance is here and whether less expensive funding is worth putting personal or business assets on the line.

- May have compounded interest, meaning that if you do not pay back quickly, the amount that you have to repay will exponentially increase. In the restaurant industry, you have to stay prepared for the unexpected. With compounding interest, the penalties for not meeting your monthly payment could significantly drive up your cost of capital.

- Term loan payments are typically billed monthly. This requires recipients to keep track of a monthly bill. A bank loan typically has compounding interest (as mentioned above), so the longer you take to pay, your cost of capital could increase exponentially.

- Flexibility in terms of length of term (typically 3-10 years) This flexibility allows you to customize the payback period to an amount of time that works well for your restaurant. The term length that you choose will typically have an impact on cost. For example, if you can afford to pay back your loan quickly, a bank will typically give you a more favorable interest rate than if you have to pay off over a longer period of time. Typically, the longer it takes to pay, the more interest you will accrue and the more you will have to repay.

Related Resource: 10 Finance Terms Every Business Owner Should Understand

2) Alternative Loans

When individuals and business owners think of applying for a loan, they usually have a traditional loan from a brick-and-mortar bank in mind, however, alternative loans from bank and nonbank lenders are another great option to consider if you’re looking for working capital or funding to start a new project at your restaurant.

Some lenders offer alternative loans in order to provide capital to approved business owners; these lenders typically have access to more sophisticated technology than brick-and-mortar banks to determine whether a candidate is qualified, and may offer more flexible repayment options.

For example, where a “brick-and-mortar” bank may look for a business to have been operating for 2+ years and require the owner to have a great credit score, a bank offering alternative loans could accept newer restaurants or base approval criteria on your business’s performance and other factors, rather than your personal credit score.

Alternative loans may also offer methods of repayment that flex with your daily sales. Rather than requiring you to make one fixed monthly or daily payment for the duration of your loan, alternative loans may offer daily payments as a fixed percentage of your credit card sales, so that payments ebb and flow with your business’s sales, making it easier for seasonal restaurants to keep up with payments.

If you’re interested in the flexibility and speed of an alternative loan, consider applying for a Toast Capital Loan. Toast Capital Loans offer eligible Toast customers fast, simple funding that can be used for any restaurant need. With repayment that flexes with sales*, no compounding interest, and no personal guarantees, Toast Capital Loans provide restaurants with access to funding from $5K to $300K. Additionally, Toast Capital Loans have one fixed fee - with no compounding interest and no personal guarantees. Better yet: once approved, you can receive your funds as soon as the next business day.**

Toast Capital Loans are issued by WebBank. Loans are subject to credit approval and may not be available to borrowers in certain jurisdictions. WebBank reserves the right to change or discontinue this program without notice.

*Toast Capital Loans offer different target repayment terms ranging from 90 days to 360 days, depending on eligibility. The maximum repayment term is 60 days following the end of the target repayment term. Any outstanding balance due at the end of the maximum term will be collected automatically via ACH.

**Funds are typically disbursed within 1-2 business days after signing your credit agreement.

3) A Small Business Administration (SBA) Loan

A Small Business Administration, or SBA, loan is a loan of funds from The U.S. Small Business Administration. It’s important to note that the SBA is not the one actually lending small businesses funds – it leans on a vast network of partner lenders to provide approved small businesses with the money they need to get their business off the ground. You will be working with a smaller, local or nationally recognized lender. As such, it can take 1 to 3 months to receive your funds depending on the type and size of your desired loan. However, due to the ongoing impact of COVID-19, wait times may exceed 3 months due to shifting risk profiles and the sheer number of loan applications under review.

SBA loans fall into two buckets: Working capital and fixed assets.

SBA loans typically require applicants to put down a significant amount of personal or business collateral to back their loan to prove their personal investment in the venture. SBA loans also have lengthy application processes that can extend for weeks or months, requiring applicants to submit years of financial statements and produce receipts for each major purchase the business has made over the course of several years. SBA loans could be a fit for you if your project has a flexible timeline and you don’t need capital on hand quickly. SBA loans also offer flexibility when it comes to the amount of funding available. Many SBA-approved lenders will originate loans up to $5.5 million, the maximum amount allowed by the SBA.

Here’s how the Small Business Administration defines eligibility for a loan:

“In general, eligibility is based on what a business does to receive its income, the character of its ownership, and where the business operates. Normally, businesses must meet size standards, be able to repay, and have a sound business purpose. Even those with bad credit may qualify for startup funding.” See here for a complete list of the eligibility requirements for a SBA loan. [2]

Source: Small Business Loans Administration, https://www.sba.gov/funding-programs/loans

4) Merchant Cash Advance

A merchant cash advance is where a provider will pay an up-front lump sum to purchase a percentage of an eligible restaurant’s future sales (typically credit card sales).

Unlike a loan where a payment is due to a lender each month, the merchant cash advance purchaser typically recoups the percentage of sales that it has purchased through a more automated approach: The majority of purchasers will collect the money owed to them through a daily ACH (Automated Clearing House) deduction from a bank account.

While most loans will present the cost of capital as an interest rate or APR, the cost of a merchant cash advance is typically presented as a factor, which is a fixed percentage of the amount advanced that is added onto the amount that the restaurant owes the purchaser.

A merchant cash advance is great for businesses that accept credit or debit card purchases. If you’re running a cashless restaurant, this may be a good option for you.

5) Business Line of Credit

A business line of credit works similarly to a credit card: An approved business owner is extended an open line of credit from a brick-and-mortar bank or an alternative lender. As with credit cards, there is typically a spending limit, which must be repaid either monthly or annually before a merchant can draw down additional credit. This option is beneficial for two big reasons:

It gives business owners working capital when they need it and the flexibility to decide how much they need

It helps business owners improve their business credit score

TOAST TIP: When exploring funding options, you should also debate whether secured or unsecured debt is best for your business: Secured debt is backed by an asset, while unsecured debt is not. Unsecured debt carries few or no personal guarantees, but it is often more expensive. Secured debt can be backed by a personal or business asset and is generally cheaper, but places more personal risk on the assets of the business or business owner. Loans and lines of credit are two examples of types of funding that can be secured or unsecured.

6) Crowdfunding

Of all the restaurant financing options on this list, crowdfunding is both the newest and the most trendy.

Crowdfunding is a business financing option where new business owners pitch their business idea or product idea to the public in exchange for a benefit – like an invite to the soft opening, a free meal, or a guaranteed reservation once a month – once it has launched. Popular sites for crowdfunding include:

Kickstarter specifically has a full section devoted to restaurants seeking crowdfunding. Restaurateurs looking for the funding to open their first location or the capital to move into the consumer packaged goods space by bottling up their famous housemade hot sauce or jam might want to explore crowdfunding.

Crowdfunding has a lot of benefits, such as the ability to reach a broad investor base, generate buzz through social media, and streamline the fundraising process. Things to consider are regulations around the amount of money an issuer can raise using crowdfunding, fees collected by the crowdfunding service provider (e.g. Kickstarter’s 5% success fee and 3% + $0.20 payment processing fee per pledge, and the disclosure requirements for certain information about the business and the fundraising effort.

7) Asking Friends or Family Members

Ah, ol’ reliable. Asking for funds from friends and family is a tried and true way to gain business funding without the red tape application and approval process.

Asking friends or family for a loan requires no credit check, no business plan, no W-2s or work history, just trust. That being said, you will want to heavily weigh out bringing your personal life into your professional life, as well as any conflicts of interest that may arise through business decisions you make that may not align with your lender’s outlook on life. Make sure the investment is well documented and you pick the partner that works for you and your business.

Along with the above seven restaurant financing options, there are three additional options – commercial real estate loans, equipment financing, and purchase order financing – that could be viable options if you have a project in mind where the specifics ladder up with how these sorts of funding must be used.

8) A Commercial Real Estate Loan

As real estate costs continue to rise, it’s getting harder to be able to afford rent on brick and mortar restaurants in an attractive location. If you’re an existing restaurant expanding by incorporating a new location or renovating your restaurant with a fresh new look, or you’re a new restaurant looking to purchase your restaurant location outright, decide whether it’s worth applying for a commercial real estate loan to help you shoulder the costs. Keep in mind that most lenders will be laser-focused on your restaurant’s financial health. Since real estate loans are generally big-ticket multi-year agreements, your cash flow and overall flexibility could be significantly impacted.

9) Equipment Financing

Whether a valuable piece of equipment broke or you’re looking to upgrade, equipment financing is a great option to get capital for restaurant equipment related projects. Here’s how it works: An equipment financing lender either sells you the piece of equipment you need or gives you the funds to buy it, and then you pay them back in monthly increments (plus interest). Some equipment financing companies will also let you take out a loan against your paid-off equipment to fund small projects within your restaurant, known as a sale leaseback. Sale leasebacks tend to have very low interest rates and attractive repayment terms compared to other sources of funding.

10) Purchase Order Financing

Looking to expand into new revenue streams, introduce your brand to new audiences, and grow profits? If you’re a restaurant with a signature product – like a hot sauce, bbq sauce, jam, or seasoning – that guests adore, testing sales in grocery stores and other brick and mortar retail locations as a consumer packaged good (CPG) could be a viable revenue option for you.

Purchase order financing gives restaurants that have already taken orders but need additional capital to fulfill them the funds they need, so it can be a good fit for brands looking to expand into the catering or consumer packaged goods space who may need help scaling to meet demand.

Now that you’ve got a better idea of the business financing options available to new and existing restaurant owners and how they work, your next question is likely about how to choose which restaurant financing option is right for you.

Restaurant Opening Calculator

This calculator lays out some of the fundamental financial costs of opening a restaurant, so you can start planning and bring your dream restaurant to life.

How to compare and evaluate bar financing options

You’ve done some planning to outline how you would use capital, researched popular business financing options, and now you’re wondering how to compare the opportunities available to you. The main characteristics business owners want to consider when comparing business financing options are:

- Cost

- Term

- Speed

- Lender or Partner

We’ve added a few additional details to consider, like:

- How quickly you can get the capital, once approved

- Evaluation of total payback

- Fixed rate payments vs. variable rate payments

- Whether you need to put up collateral

- Reputation of the lender

1 . Consider how quickly you can get your capital

Before you choose to go with one restaurant financing option over another, consider how long it

will take until the capital is available to be put toward the project you have in mind. Ask your potential lender (or other third party financing provider) what information they need, eligibility criteria, and an anticipated timeline that you can expect to hear back, but also ask yourself: Can you wait for the capital with a longer term build out, or do you need to replace a broken oven today?

2. Evaluate the total payback

There are many different types of cost structures that lenders use and there are equally as many factors to consider when determining total cost, including total payback amount, APR, upfront fees, compounding interest or other penalties, and more.

There is a common misconception that annual percentage rates (APR) and interest rates are the same thing. APR is a calculation that looks at all interest, fees, and the timing of those fees on equal ground. APR is expressed as a percentage and represents the yearly cost of borrowing funds. While APR is important for comparing funding options, it isn’t the end all be all. Another factor used to assess the cost of a loan is the absolute dollars you will pay back for the funding you receive (inclusive of application costs, interest, late fees, origination fees, etc.). APR doesn't necessarily translate to the total amount repaid for the amount borrowed. Take a look at our two examples below.

Fixed interest rate loan with a 3-year term

- $10,000 loan

- 10% fixed annual interest rate, paid monthly, not compounding

- Term: 3 years

- No additional fees

For this example, the total payback is $11,616 for the $10,000 borrowed. This corresponds to an APR of 10%.

Compare the example above with the example below. You will see that while the APR is higher for the next example, it has a lower total payback.

This loan has a fixed cost (called a factor rate), 9-month term, no accruing interest:

- $10,000 loan

- Interest rate = N/A

- Term: 9 months

- Factor rate of 1.16 (corresponds to a fixed cost of $1,600)

The total payback is calculated by multiplying the factor rate of 1.16 by the loan amount of $10,000. For this example, the total payback is $11,600 ($10,000 loan + $1,600 fixed cost) for the $10,000 borrowed. This corresponds to an APR of 62%, even though the total amount that you would repay is roughly the same amount that you would repay in the example above. This is because you are repaying the loan amount plus the additional cost in a shorter period of time (nine months vs. three years).

Bottom line? By calculating the absolute dollar amount you will pay back and comparing it to your other offers, you can determine which funding option works best for your budget and cash flows. It is important to pay close attention to any additional fees, like late fees, that you may incur with the funding you receive so that you have a full picture of the total cost of borrowing.

3. Compare the Term

The third characteristic you should evaluate when comparing business financing options is the repayment term (if there is one for the financing option you select) as it dictates the size of your regular payments. The repayment term refers to the amount of time you have to pay back the amount of funding you receive.

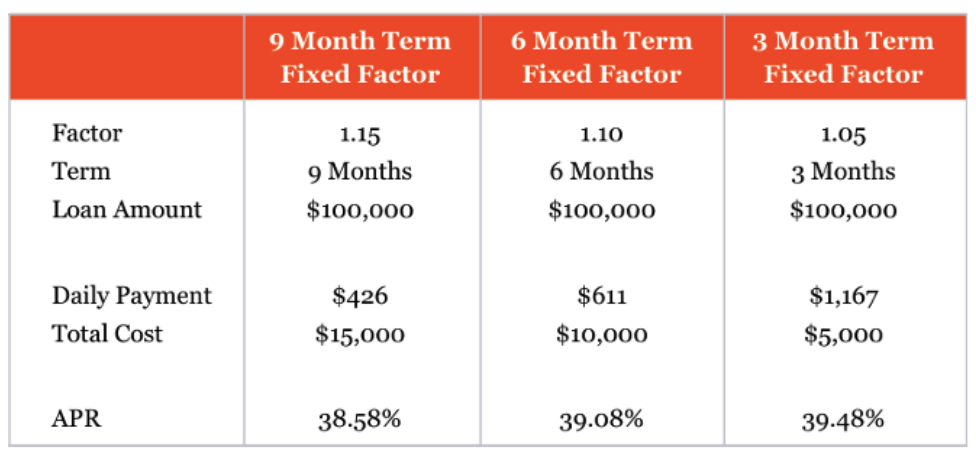

Here is an example of a loan with a fixed factor rate. We have assumed a loan of $100,000 with differing terms of 9 months, 6 months, and 3 months.

You may notice a significant difference in total cost in favor of the 3 month term, however, the shorter-term source has the highest APR of all of these options. The significantly higher daily payment required by a shorter term results in a higher annual percentage rate. If you can afford the payment, great, but not everyone can.

4. Weigh out the benefits of fixed rates vs. variable rates

If approved for a loan, you’re not just going to be paying back the loan amount, rather you will be responsible for paying back the amount borrowed plus interest or a fixed cost. The interest rate or factor rate (fixed cost) may be based on a variety of potential factors like your sales history, personal credit score, how long you’ve been in business, any debt your restaurant has, and more. Interest rates can either be fixed rate – meaning they do not fluctuate during the life of the loan – or variable rate – meaning the interest rate can fluctuate throughout the life of the loan based on economic conditions.

When comparing business financing options that have an interest rate, you’ll want to consider whether fixed rate or variable rate interest payments are more affordable.

5. Find out if collateral is required

As defined by Investopedia, collateral is “an asset that a lender accepts as security for a loan. If the borrower defaults on the loan payments, the lender can seize the collateral and resell it to recoup the losses.”

Sometimes, in exchange for a loan of a large sum of money, banks and other lenders will require you to offer up a valuable item – like your house, a car, or your business’s brick and mortar location – as collateral that they would then own should you default on your payments. It’s important to note that some lenders will require you to offer up collateral that is the property of the business – like the funds in the business's account, your food truck, or your brick and mortar location (if you own it), while other lenders may require personal assets (your house, your car, your retirement fund) if they require a personal guarantee, which requires you to put your own assets and personal well being on the line if anything goes wrong.

Offering up collateral can be incredibly stressful, knowing that should you default on your payments, you may lose something meaningful and valuable to you, so it’s important to weigh out the benefits and risks before you sign on the dotted line.

6. Consider the reputation of the financial provider

Do you know the financial provider or others who have worked with them in the past? Will they work with you if you miss a payment or run into trouble? How much volume do they do with the capital product you selected? Do they specialize in working with restaurants?

You may want to focus your search on financial providers that take into consideration restaurant industry challenges, as they may be more likely to take seasonality into account when determining your rate, rather than denying your application because of it. They may also be more permissive of low profit margins, which are standard within the restaurant industry (cite average profit margin) but could be a red flag to a brick-and-mortar financial institution.

You may also want to explore lenders that you have an existing relationship with, or that partner with your service providers, as those lenders and your service providers are likely to be more invested in your business’s success and expansion. For example, POS providers, accounting systems (like QuickBooks), and payment processors may be a good choice to partner with for funding, given your existing relationship with them.

When you have your initial meeting with a potential lender, make sure the interview is going both ways: you should be asking just as much about them as they are about you. You need to make sure that this lender is reliable, has a good rapport with other clients, and won’t pull any funny business a few months down the road.

Restaurant Opening Calculator

This calculator lays out some of the fundamental financial costs of opening a restaurant, so you can start planning and bring your dream restaurant to life.

Financing your bar with a Toast Capital Loan

Alternatively, you might consider getting access to loans through your POS provider, like Toast. These loans may give you the ability to repay your loan amount through a fixed percentage of your daily credit and debit card sales. In this way, your payment processing system automates your loan repayment, taking one less thing off your busy plate.

Toast Capital offers many customers access to loan amounts ranging from $5,000-$300,000, based on eligibility, so that you can get exactly the loan you need to fund business operations.

Many restaurant owners choose Toast Capital Loans because:

Funding is quick and painless

Once you’ve been approved and signed your Toast Capital Loan agreement, you can expect funds to be sent to your bank account in as soon as one business day*

Applying for a Toast Capital Loan does not affect your credit score

Toast Capital Loans can be used for any restaurant need, ranging from hiring employees to purchasing inventory and equipment to purchasing payment processor equipment

Repayment of your Toast Capital Loan is estimated at 90 days or 270 days depending on your loan amount and eligibility.** Toast Capital Loans are flexible, convenient, and don’t require you to make a fixed monthly payment.

Toast Capital Loans are issued by WebBank. Loans are subject to credit approval and may not be available to borrowers in certain jurisdictions. WebBank reserves the right to change or discontinue this program without notice.

*Toast Capital Loans offer different target repayment terms ranging from 90 days to 360 days, depending on eligibility. The maximum repayment term is 60 days following the end of the target repayment term. Any outstanding balance due at the end of the maximum term will be collected automatically via ACH.

**Funds are typically disbursed within 1-2 business days after signing your credit agreement.

Related Bar Business Resources

- How to Open a Bar

- How to Write a Bar Business Plan

- Bar Business Plan Template

- Bar Names

- Bar POS System

- Best Bar Websites

- Cost to Open a Bar

- Bar Marketing Ideas

- Bar Design Ideas

- Bar Branding

- Bar Ideas and Concepts

- Bar Licenses and Permits

- Bar Floor Plans

- Bar POS Comparison Tool

- Bar Equipment List

- Best Bar POS Systems

- Bar Supplies

Restaurant Opening Calculator

This calculator lays out some of the fundamental financial costs of opening a restaurant, so you can start planning and bring your dream restaurant to life.

Is this article helpful?

DISCLAIMER: This information is provided for general informational purposes only, and publication does not constitute an endorsement. Toast does not warrant the accuracy or completeness of any information, text, graphics, links, or other items contained within this content. Toast does not guarantee you will achieve any specific results if you follow any advice herein. It may be advisable for you to consult with a professional such as a lawyer, accountant, or business advisor for advice specific to your situation.

Read More

Subscribe to On the Line

Sign up to get industry intel, advice, tools, and honest takes from real people tackling their restaurants’ greatest challenges.