You Need to Talk to Your Landlord

Based on what the CARES Act addresses regarding coronavirus rent relief, here’s what you’ll need to talk to your landlord about.

Chelsea VerstegenAuthor

This post was written on April 24, 2020.

The spread of COVID-19 has had tragic effects on communities around the world.

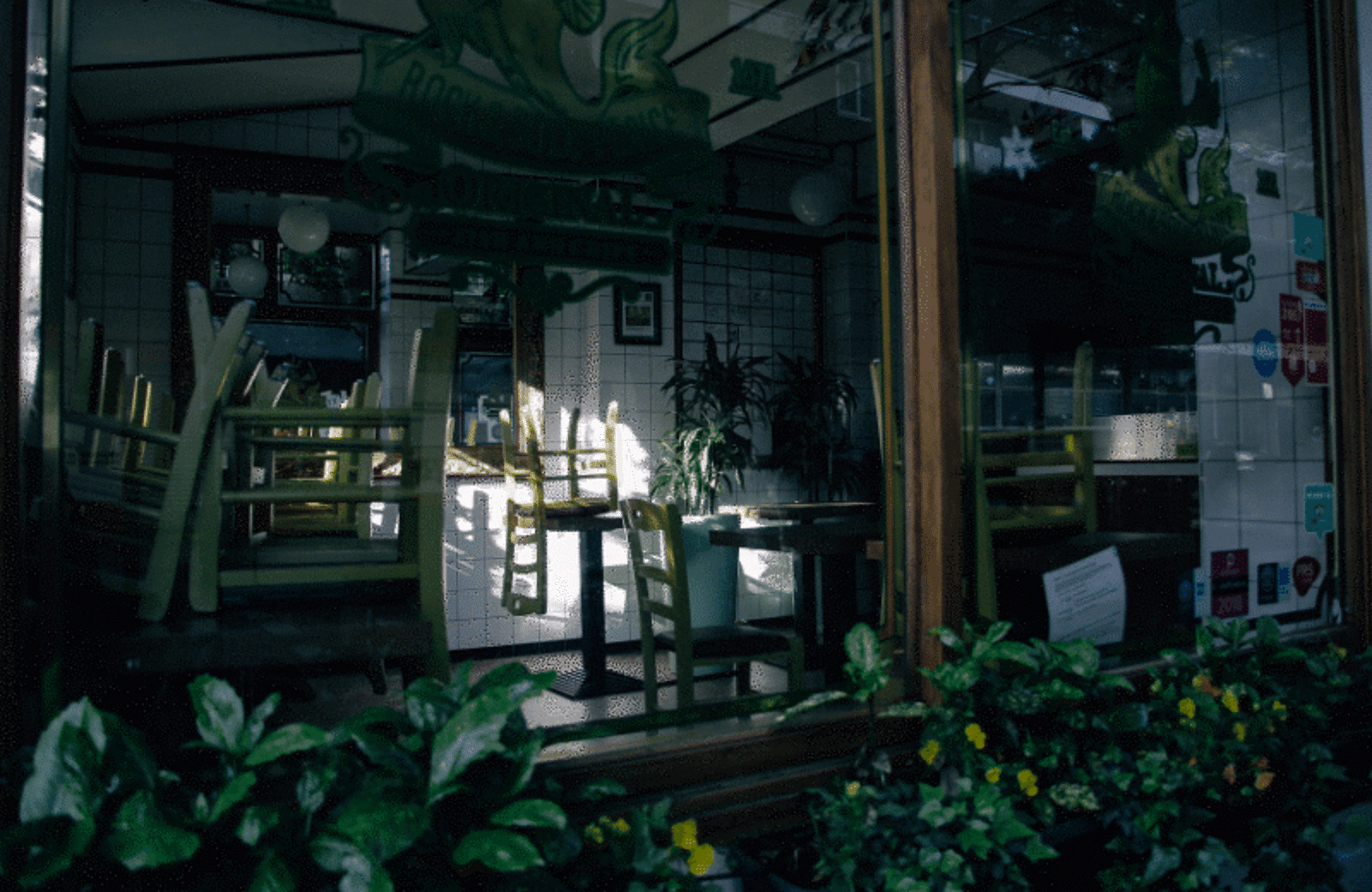

There likely hasn’t been a day that’s gone by this year where you haven’t heard about the human and economic impact of this pandemic. Many businesses — including both independent and corporate restaurants — have been deeply impacted by the changing habits of diners, and the government’s responses to the health crisis.

As restaurant sales plummeted nearly 80% in the March because of COVID-19, companies pivoted operations to focus on takeout and online ordering to attempt to salvage some of their profits. But restaurants that aren’t used to relying solely on takeout and delivery orders are understandably still suffering. More than 12 million people work in restaurants in the US, and the economy as a whole is deeply dependent on the restaurant industry. If restaurants collapse, the rest of the economy will soon follow.

On March 27, 2020, the US federal government passed the stimulus bill called the “Coronavirus Aid, Relief, and Economic Security Act”, or the CARES Act, with the intention of addressing the economic impact of COVID-19. The CARES Act includes measures for individuals and businesses that were affected by the social distancing and shelter-in-place mandates that have been enforced on a state and national level.

Though this relief package offers a great deal for small business owners, you may still have to initiate some potentially difficult conversations with your landlord. Based on what the CARES Act addresses regarding Coronavirus rent relief, here’s what you’ll need to talk to your landlord about.

And, just so you know, information about the CARES Act is rapidly developing, with new information coming out every day. This information is up to date as of the date at the top of this article. We will do our best to provide you with updated information as it becomes available to us.

Also, this content is for informational purposes only and is not intended as legal, accounting, tax, HR, or other professional advice. You’re responsible for your own compliance with laws and regulations. Contact your attorney or other relevant advisor for advice specific to your circumstances.

Manage Your Restaurant's Finances During COVID-19

In this Excel spreadsheet, you'll find customizable templates, tools, and calculators to help you analyze and optimize your restaurant financials.

If you need some guidance when drafting an email to your landlord, we’ve created this general email template that you can use to send your landlord a request for rent relief if you have experienced hardship due to the impact of COVID-19.

Keep reading below to learn about the nuances of the CARES act.

"Dear [Name of landlord],

The COVID-19 pandemic is a social and economic crisis, and our community has not been spared. [Insert restaurant name] has suffered substantial losses due to the sudden impact of COVID-19 driven by [social distancing and required shelter-in-place measures]. While hopefully temporary, these measures have been necessary. I value our partnership and am expressing my immediate need for rent relief in the form of [insert rent relief option, e.g. one month free].

My business’s contribution to our local community goes beyond our front door. We employ hard-working individuals who rely on a paycheck for essentials. Your support during this difficult time will help us weather the effects of this unprecedented pandemic.

Best,

[Your Name]

[Restaurant Name]

[Cell Phone]

[Business Address]"

What’s in the CARES Act?

Here are some of the important provisions included in the CARES Act that may affect your income, and because of that, your conversations with your landlord.

The Paycheck Protection Program

The Paycheck Protection Program provides small businesses with 100% federally guaranteed loans called Paycheck Protection Loans (PPL). The intent of the program is to prevent small businesses affected by the pandemic from going under, as well as keep small business workers from losing their jobs. A PPL used to pay for certain payroll costs, interest on a mortgage (but not principal) or rent (for agreements in force before February 15, 2020), or utilities (in service prior to February 15, 2020) may be eligible for loan forgiveness — meaning that you may not need to repay them.

Qualified Property Improvement Write Offs

Restaurants can write off costs incurred from facility improvement immediately rather than having to depreciate improvements over 39 years, which was previously required under the Tax Cuts and Jobs Act.

Changes to Economic Injury Disaster Loan Eligibility

Stipulations for applying for an Economic Injury Disaster Loan (EIDL) have changed with the CARES Act, and certain standard EIDL requirements are no longer necessary. The CARES Act eliminated the requirement that a small business not be able to obtain credit elsewhere, as well as certain collateral and personal guaranty requirements.

The CARES Act made it possible for small businesses that applied for an EIDL between January 31, 2020 and December 31, 2020 to request a grant of up to $10K. As of July 11, 2020, the SBA announced the conclusion of this grant program because all funds have been allotted, however, businesses can still apply for an EIDL.

Borrowers who received an EIDL between January 31, 2020 and April 3, 2020 can refinance their EIDL into a PPL. Refinancing from an EIDL to a PPL could be beneficial because PPL amounts used for specific purposes during the eight weeks after the loan is made can be forgiven. Small businesses can take out an EIDL as well as a PPL, provided that they are not used for the same purpose. For more information on both EIDLs and PPLs, visit https://pos.toasttab.com/blog/on-the-line/sba-cares-act

Tax Relief for Businesses and Individuals

Included in the CARES Act is the ability to defer payment of the employer portion of employee-withheld Social Security payroll taxes, and an employee retention tax credit of up to 50% of qualified wages paid after March 12, 2020, and before January 1, 2021, if the employer’s operations were fully or partially suspended due to COVID-19 or the employer's gross receipts declined by a specific percentage in a quarterly year-over-year comparison.

Unemployment Compensation

The CARES Act authorizes an additional $600 per week to certain employees who are already receiving unemployment benefits. Certain forms of workers, who would not otherwise be covered by state unemployment compensation rules, or who have maxed out their state unemployment compensation, may also be eligible to receive unemployment compensation as well.

What Should Be Communicated to Your Landlord

There are cities and states that have paused evictions due to COVID-19, and the CARES Act puts a 120-day eviction moratorium in place for tenants in properties that are part of government programs or that have a federally-backed mortgage loan.

Unfortunately, a nationwide eviction moratorium has not been declared, so millions of small businesses need to figure out their next steps.

Talking to your landlord can feel daunting, but there are ways to approach it that show you’re a partner to your building owner. Here are some things to remember and topics you can cover throughout your conversations.

You Are Your Landlord’s Partner

The first thing you need to remind yourself of is that you are not alone. Along with millions of other individuals and businesses, your landlord’s livelihood is at risk at the moment as well. The last thing your landlord wants is to lose you as a tenant because there’s no telling how long it could take them to find another lessee, especially in this time of economic turmoil. Remember that talking about what you need to keep your doors open is incredibly important to the both of you.

Discuss Rent Relief

Requesting rent relief from your landlord could mean the difference between paying your staff or not. If that’s the case, don’t be afraid to communicate it.

There are several options for rent relief that you can request of your landlord, including:

Rent reduction, which means your rent would be reduced by a certain percentage for a portion of the lease.

Rent deferral, which allows you to repay your rent on a delay.

Rent abatement, which gives you a period with reduced or no rent payments to maintain your residence.

Flexible payment options, which includes a repayment in smaller sums or payments as a percentage of sales as business picks back up.

Each of these would still require you to pay rent, but could make the repayment much more manageable as we wait for the pandemic to end.

When You Plan to Resume Business as Usual

You should have a game plan when addressing the amount of time you’ll need to get back on your feet before you contact your landlord. It’s important to communicate that your business has been affected by COVID-19, as well as how long you believe you’ll be impacted when you start discussing options for rent relief.

Your plans, of course, may change, but coming to your landlord with a thoroughly researched and thought out plan is much more promising than saying you’re not sure when you’ll get things back on track. Be sure to communicate with your landlord if and when things shift and your plans change.

Know Your Rights

Before you talk to your landlord, review your lease contract to see if there are any provisions related to epidemics or pandemics, as well as what you and your landlord can and can’t do. For example, your landlord likely can’t rent your space out from under you. However, depending on where you’re located, your landlord may be able to evict you for not paying your rent. That’s why this communication is so important.

When it comes to talking to your landlord about rent, time is of the essence. Move swiftly and do your research. Consider talking to an attorney if anything is unclear or if you have questions regarding what you’re entitled to before you reach out to your building owner. Keep in mind that you’re in a partnership, and that there are relief measures in place to keep your business up and running.

Related Restaurant Cost Resources

Manage Your Restaurant's Finances During COVID-19

In this Excel spreadsheet, you'll find customizable templates, tools, and calculators to help you analyze and optimize your restaurant financials.

Is this article helpful?

DISCLAIMER: This information is provided for general informational purposes only, and publication does not constitute an endorsement. Toast does not warrant the accuracy or completeness of any information, text, graphics, links, or other items contained within this content. Toast does not guarantee you will achieve any specific results if you follow any advice herein. It may be advisable for you to consult with a professional such as a lawyer, accountant, or business advisor for advice specific to your situation.

Read More

Subscribe to On the Line

Sign up to get industry intel, advice, tools, and honest takes from real people tackling their restaurants’ greatest challenges.