The Guide to Restaurant Credit Card Processing And Deposit Tracking

Learn how restaurant credit card processing and deposit tracking works.

Tessa ZuluagaAuthor

Restaurant Operations Manual Template

Use this free template to easily outline all of your operating procedures and make day-to-day operations as consistent as possible.

Get free downloadHow many times have you opened up your debit and credit card processing statement, only to be bombarded with a laundry list of shorthand, abbreviations, and otherwise undecipherable terms?

Debit and credit card processing fees are a major component of every restaurant’s expenses; despite this, card processing fees remain a mystery to many. Trying to understand how debit and credit card processing works is pretty difficult; at times, the entire industry can feel like a black box of sorts. With all this information floating about on the Internet, where is the best place to start?

Look no further — we’ve got you covered with this Guide to Restaurant Debit and Credit Card Processing. Below, we’ll walk you through everything you need to know: how you get your payment, key parties involved in the process, common debit and credit card fees, payment processing pricing structures, and more. We’ll also discuss how Toast’s Instant Deposit feature can help you take control of your cash flow.

Let’s dive in.

Restaurant Cost Control Guide

Use this guide to learn more about your restaurant costs, how to track them, and steps you can take to help maximize your profitability.

What is Credit Card Processing?

On the surface, debit and credit card processing seems to be a simple procedure: a customer pays for their meal and your restaurant gets paid for it; your POS, handheld, kiosk, or website backend handles the rest automatically, right? Despite how seamless this operation appears, there are multiple steps and parties involved in ensuring secure, valid, and smooth transactions. The information and data transferred from party to party through the vast, advanced processing infrastructure can happen in a matter of seconds, but the process is only as fast — and secure — as the weakest link in this chain.

We’ll break down exactly what happens when your restaurant processes a debit or credit card transaction with a helpful graphic in the next section of this article, but there are essentially three key steps in the process outlined below.

Authentication: the process kicks off when a cardholder presents their debit or credit card to make a purchase. The card issuer has to make sure that the customer is the rightful cardholder and that the card used for their purchase is valid. If successfully authenticated, the process moves on to authorization.

Authorization: the card issuer reviews the cardholder’s account to determine whether the cardholder has sufficient funds to pay for the cost of the purchase and approves or denies the transaction accordingly.

Settlement: if the purchase is approved, funds are settled to the appropriate merchant accounts, net of (deducting) any fees paid to parties involved with these payment processing steps.

For their roles in the debit and credit card processing value chain, card-issuing banks and card networks receive specific interchange, network, and assessment fees, which we will cover later in this article. In 2021 alone, merchants in the U.S. paid a total of $137.83 billion on processing and interchange fees — resulting in a more than 24% increase compared to the year prior.

From large multi-unit operators to small businesses in the food and beverage industry, it is imperative to select a processor that is reliable, secure and provides the value they need due to the sheer cost of underlying processing fees. Not only that, but the processor has to keep up with the technology restaurants need to thrive — whether it’s EMV, contactless payments, QR code payments, or other innovations that advance the restaurant industry.

You can read more about the ins and outs of debit and credit card processing here.

How Restaurant Debit and Credit Card Processing Works

Before getting into our payment processing diagram, let’s first answer a quick question: who is involved with debit and credit card processing?

Cardholder

The cardholder, or your guest, can pay for their meal or service in several ways. They can physically present their card for processing (via swipe, EMV dip, or contactless touch) to initiate a “card-present” transaction, or have their card manually keyed-in (such as via an online or phone order) to initiate a “card-not-present” transaction.

Merchant

Merchants are restaurants, cafes, and other food and beverage businesses in this case. Merchants, along with the cardholder and debit and credit card processor, initiate the payment processing procedure.

Debit and Credit Card Payment Processor

Payment processing providers facilitate the flow of payment messages between merchants and card networks. They batch information and authorization requests along to the card network and ultimately clear the transaction and provide data messaging services that enable money to be deposited from the issuing bank to the merchant’s bank account.

Card Networks

Debit and credit card networks — such as Visa, MasterCard, Discover, and American Express — govern the payment process. They also set interchange fees and facilitate communication between issuing banks, debit and credit card processors, and merchant banks. Card networks are often also referred to as “card brands” and “card associations.”

Issuing Bank

The issuing bank is the financial institution that issues debit and credit cards to their clients. These cards are branded by the card networks described above. They are ultimately responsible for settling with merchants such as restaurants every day, and maintaining the cardholder’s account for purposes of billing and statementing. Some card networks, namely American Express and Discover, also own an issuing bank and develop and issue their own cards.

Merchant Bank

The merchant bank is the financial institution that helps facilitate payment processing and provides merchants with the ability to accept debit and credit card payments and receive their funds from those transactions. Beyond providing merchant accounts, loans, and other financial services, some merchant banks have the capacity to act as the payment processor too. Merchant banks are often also referred to as “acquiring banks” or “merchant acquiring banks.”

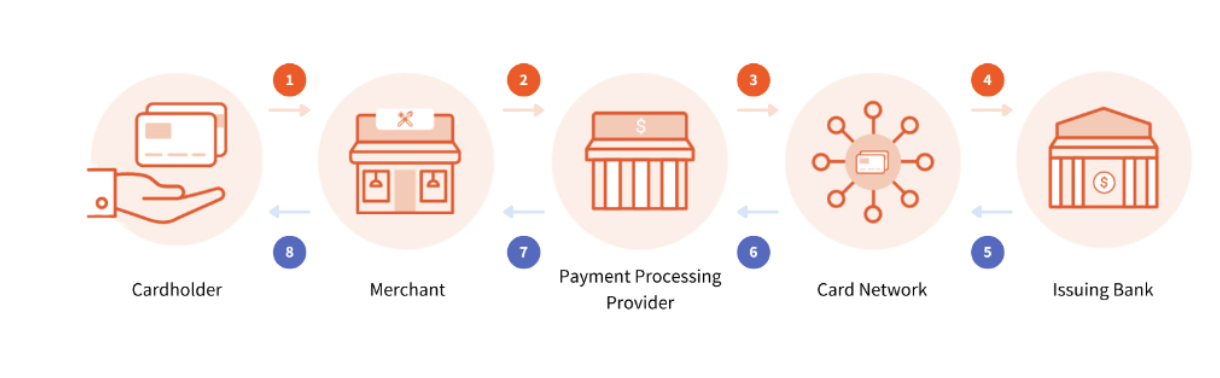

Transaction Flowchart

Below, you can find a summarized flowchart of steps for a debit and credit card processing transaction.

Let’s explore each of these steps:

The cardholder presents their credit or debit card to pay for their order through a terminal (POS system, handheld, or kiosk), or the card information is entered manually through an online ordering portal, or elsewhere for a card-not-present transaction

The merchant’s terminal automatically begins the electronic payment authorization process by relaying the cardholder’s information to the merchant’s payment processing provider

The payment processing provider sends the cardholder’s information to the respective card network

The card network requests authorization from the issuing bank

The issuing bank determines whether funds are available in the Cardholder’s credit or debit account; if the issuing bank determines funds are available, it approves the transaction by sending an authorization message to the network

The network relays the authorization message it received from the issuing bank to the merchant’s payment processing provider

The merchant receives the issuing bank’s authorization through their payment processing provider

The merchant provides a receipt or confirmation to the cardholder

Finally, the merchant batches all approved authorizations and sends them in a batch, typically at the end of the day, to the payment processing provider. The payment processing provider reconciles and formats the batch files it receives and transmits them to the appropriate card networks. The card networks route the transaction information to each issuing bank in the batch for the issuing bank to transmit funds through the network to the merchant’s bank account, a process known as “settlement.” Settlement is the last step of this process — after the involved parties each take their cut of each transaction through their respective fees, the merchant bank deposits the remainder received from the issuing bank into the merchant’s bank account.

Types of Debit and Credit Card Processing Pricing Structures

There are three primary types of restaurant payment processing pricing structures: Flat Rate, Interchange Plus, and Tiered Rate. They each have their own advantages and disadvantages — at least at first glance — but it’s ultimately up to you to decide which pricing structure makes the most sense to select.

Flat Rates

Flat rate pricing is an increasingly popular restaurant payment processing structure — primarily due to its clarity and simplicity. With a flat rate pricing structure, restaurants pay a specific, fixed fee percentage for the majority of their debit and credit card processing fees. Oftentimes, American Express and Card-Not-Present (CNP) transactions may carry their own specific flat rates depending on the restaurant payment processing provider.

The main benefit of flat rate processing is clarity. Restaurants will know exactly what rate they will pay for their card processing fees with flat rates. As mentioned before, there may be a couple of different flat rate fees for specific card or transaction types, but flat rates are easy to understand as a whole. This also leads to easier forecasting since the flat rates are fixed.

However, the primary drawback of flat rate restaurant payment processing is the lack of underlying detail when it comes to a restaurant’s card processing fees.

You can read more about Flat Rates here.

Interchange Plus (IC+)

Interchange Plus is a very popular, albeit older, restaurant payment processing pricing structure. As a cost-plus pricing model, the payment processing provider layers its processing fees on top of other underlying debit and credit card fees, which we will explain in more detail later in this guide. The main component of these underlying fees is the “interchange” fee, collected by the card-issuing bank and set by the card network. Interchange Plus payment processing fees will vary based on card networks, card types, and transaction types. Each of these combinations results in a different amount of underlying fees.

There are two primary benefits to the Interchange Plus pricing structure:

Transparency: since the underlying debit and credit card fees are separated from the payment processing provider’s markup, you get to see exactly how much you’re paying to the payment processing provider for its debit and credit card processing services.

Customer card mix detail: Interchange Plus debit and credit processing statements generally provide a great level of detail for underlying interchange fees. This can help you determine what percentages of your customer base uses what types of cards, giving you more insight into what’s driving your total payment processing fees.

Interchange Plus carries a couple of key drawbacks related to its deep level of detail:

Complicated: the sheer amount of various underlying debit and credit card fees listed in an Interchange Plus statement can be highly confusing for many restaurateurs.

Difficult forecasting: since there are different underlying fees for each card type, of which there are hundreds, it becomes difficult to forecast debit and credit card processing fees when making a budget.

You can read more about Interchange Plus here.

Tiered Rates

With tiered debit and credit card processing pricing, the restaurant payment processing provider bundles each card’s interchange rate into a variety of buckets, or “tiers.” Processors can create as many tiers as they want, but a three-tiered system is the most common. Typically, the three tiers are qualified (QUAL), mid-qualified (MQUAL), and non-qualified (NQUAL), though you’ll sometimes see less-than-clear tiers like “high-qualified” (HQUAL), among others. Qualified rates are the lowest, and transaction rates increase for mid-qualified and non-qualified transactions — seeing qualified terms on your processing statement is a dead giveaway that you’re on a tiered rate structure.

One important distinction to make is that American Express discount rates (their version of interchange rates) are generally titled as tiers as their naming convention (such as Restaurant Tier I, Tier II, and Tier III). This does not imply a tiered processing rate structure — remember to look out for the QUALs instead of looking for Tiers.

Qualified transactions must meet all of the processor’s criteria to be processed at the lowest qualified tier’s rate, and failure to meet one or more standards may result in a ‘downgrade’ to mid-qualified or non-qualified tiers. The debit and credit card processor sets the rates and fees for “qualified,” “mid-qualified,” and “non-qualified” payments as they see fit. The alluringly low headline rate for the qualified tier can often be enough to draw in inexperienced business owners who think the qualified rate will be their overall restaurant payment processing rate. However, since restaurants have no control over which cards fall into what tier or what cards their guests pay with, restaurants can quickly get locked into a contract with unfavorable, opaque rates.

Beyond this, you’ll often still find a slew of network and assessment fees alongside processor markups and other fees, making it difficult to uncover your “true” processing cost.

Read more about Tiered Rates here.

Types of Debit and Credit Card Processing Fees

Debit and credit card processing fees can effectively be broken down into two main categories. The first category is “real fees” that are tied directly to debit and credit card processing costs — such as interchange fees, network assessment fees, other network fees, and payment processing provider fees. Card networks generally change interchange and network assessment fees in April and October.

The second category is monthly fees — some of which are “real” fees for software and service subscriptions, while some are “hidden” or “padded” fees that aren’t actually tied to any underlying restaurant payment processing service. Toast doesn’t supplement its rates with any hidden fees, so what you see is what you pay — you can learn more about Toast’s rates here.

“Real” Fees

Interchange Fees

These are debit and credit card processing costs that are charged by issuing banks and generally come in the form of a combined variable (% of transaction size) and fixed (per-transaction) fee. For example, a rewards card could carry an interchange rate that costs 2.40% on the dollar volume of a transaction + $0.10 per transaction. Interchange fees are how issuing banks generate revenue when issuing debit and credit cards to cardholders.

Interchange rates are set by card networks depending on the “value” and “risk” of specific cards and transaction types. As such, there are hundreds upon hundreds of different interchange fees tied to the different card types in circulation for each card network, such as various debit, credit, rewards, and premium cards. However, there will only be one specific interchange fee tied to an individual card’s transaction.

Network Fees

For the purposes of this article, we’ll use “network fees” to refer to fees that are set by and paid to card networks in exchange for the services that they provide to facilitate debit and credit card transactions. Network fees generally take the form of either a variable per-transaction fee (% of transaction size) or a fixed per-transaction fee.

Assessment fees are a type of network fee that is applied to the total processing volume tied to each card network and are often the largest bucket of fees within this category. As of April 2021, specific assessment fees are as follows:

Visa (credit): 0.14%

Visa (debit): 0.13%

Mastercard: 0.13%

Discover: 0.13%

American Express: 0.16%

There are also network fees specific to certain characteristics of each transaction, such as if an order is manually keyed in, paid for with an international card, or doesn’t meet certain security or verification criteria. For instance, Visa charges a “Transaction Integrity Fee” (or TIF) of $0.10 each time a zip code is not entered for any hand-keyed transaction (such as an order placed over the phone).

Some other examples of network fees include network access fees, international service and support fees, data usage fees, and AVS and CVC2 verification fees.

Restaurant Payment Processor Fees

These are fees charged by restaurant payment processing providers for the payment processing services that they provide. Some providers include additional services as part of their fees as well; for example, Toast includes real-time machine learning-based fraud monitoring, reporting and analytics, and more as part of its rate.

A chargeback is a reversal of funds that is initiated by or on behalf of the cardholder, for example due to fraudulent or unauthorized activity. This could happen for a variety of reasons, such as when a payment is processed with a counterfeit card (true fraud) or when a customer goes through their card-issuing bank to initiate a chargeback for their meal or service without a good reason and simply because they don’t wish to pay (friendly fraud).

Since friendly fraud is usually initiated by the legitimate cardholder, it is the most difficult type of fraud to avoid. This article, Everything You Need to Know about Restaurant Fraud Prevention, goes into deeper detail about the types of fraud and ways restaurants can help prevent the occurrences of fraud.

Chargebacks generally carry a fee of $15 to $25 for each transaction that is reversed depending on the processor, so it is important to understand restaurant fraud to help keep chargeback rates low.

SOPs Template

This template will help you create SOPs for your entire business, so you can create consistency and easily train employees.

Hidden vs. Real Monthly Fees

Hidden Fees

Have you ever scanned through your monthly statements and found some fees that you don’t recognize or don’t get any value out of? Some restaurant payment processing providers are notorious for wedging in hidden fees and sometimes even inflate or add “padding” to real fees. These hidden fees are often thrown in to offset a processor’s competitive-looking debit and credit card payment processing quoted rate (or “headline rate”).

Hidden fees that don’t offer much benefit — such as a $10 “statement fee” to simply receive a statement or a monthly penalty for a restaurant that is not PCI compliant, where the processor does not offer PCI compliance services — can easily cause a restaurant’s opinion of its processor to turn sour.

Add-ons and software fees

Unlike hidden fees, add-ons and software fees are legitimately tied to a specific benefit or software solution, such as an email marketing solution or a monthly cloud-based software subscription.

Toast’s Instant Deposit

Now that we’ve established how different card processing works, let’s discuss how you can get your money faster with Toast’s Instant Deposit. If your restaurant is looking to access its sales immediately, consider Instant Deposit. With instant deposit, your funds are typically available in less than 30 minutes. This product enables your restaurant business to:

Initiate a deposit whenever you need it.

Access your money on demand — available to you for a 1.75% fee per deposit

Set up your first instant deposit in a few quick steps. Simply link your debit card to initiate your deposits.

Weekends or holidays? It makes no difference. You can gain access to your funds in 30 minutes or less, every day of the year.

Take control of your restaurant's cash flow with instant deposit. You can get access to your funds, in real time for a fee -- even on weekends and holidays. No more worrying about last-minute cash needs.

For more information check out this video.

Debit and Credit Card Processing

As we’ve shown, there are multiple moving pieces when it comes to debit and credit card processing. Between all the parties involved, hundreds of different fee types, and costly fraudulent charges, getting the most bang for your buck when selecting the right restaurant payment processing partner for your business is paramount.

Instant Deposit disclaimer: The maximum amount you can request instant deposit is $5,000 per 24 hour period. However, Toast may establish different or additional limits depending on certain factors. If you are new to instant deposit, or if you add a new debit card, the maximum daily available amount will be lower, and increase as you continue to use instant deposit. The minimum amount for an instant deposit transaction is $25. Additional limits may apply as set by the bank that issues your debit card, including limits on the number of instant deposits you can initiate on a given calendar day.

Is this article helpful?

DISCLAIMER: This information is provided for general informational purposes only, and publication does not constitute an endorsement. Toast does not warrant the accuracy or completeness of any information, text, graphics, links, or other items contained within this content. Toast does not guarantee you will achieve any specific results if you follow any advice herein. It may be advisable for you to consult with a professional such as a lawyer, accountant, or business advisor for advice specific to your situation.

Read More

Subscribe to On the Line

Sign up to get industry intel, advice, tools, and honest takes from real people tackling their restaurants’ greatest challenges.