How to Calculate Restaurant Debt-to-Equity Ratio [Free Calculator]

A restaurant's debt-to-equity ratio is a strong predictor of its financial health.

Olivia JoslinAuthor

The Guide to Restaurant Sales

In this Guide to Restaurant Sales, you’ll learn the metrics you need to measure to understand the financial health of your restaurant. Plus, you’ll get tons of great ideas that’ll help you learn how to improve sales in your restaurant.

Get free downloadAs a restaurant owner, you have the option to leverage debt to help grow your business, but you also have an obligation not to take on too much debt and risk defaulting on your loans.

This is where looking at the debt-to-equity ratio can be helpful. A restaurant’s debt-to-equity ratio is critical if you are ever planning to take on debt to grow the restaurant, sell the restaurant in the future, or monitor the health of your business.

As a Harvard Business Review article states, “any company that wants to borrow money or interact with investors should be paying attention” to the debt-to-equity ratio.

Free Download: Restaurant Numbers & Metrics Calculator

Restaurant Metrics Calculator

Use this free calculator to calculate the key restaurant metrics needed to understand the health and success of your business.

What is Restaurant Debt-to-Equity Ratio?

Plainly stated, debt-to-equity ratio is a measure of how much debt you have in relation to equity (or value of the company).

The benefit of debt is it is a relatively inexpensive way to fund the growth of your company in comparison to giving out equity to investors. You can pay the debt back over time, usually at an interest rate, and still retain full ownership of the business.

The danger of debt is that the more you take on, the more you will have to generate cash flow to pay it back, and investors perceive this as undertaking risk. Therefore, as the debt-to-equity ratio increases, so does the perceived risk, because these debts would need to be repaid in the event the company needed to liquidate.

How to Calculate Restaurant Debt-to-Equity Ratio (Formula)

Debt-to-Equity Ratio = Total Liabilities / Total Equity

Debt-to-equity ratio is the result of dividing total liabilities by total equity. Total liabilities and total equity can typically be found directly on the Balance Sheet for the business.

If you have these numbers handy, use this calculator to find your restaurant debt-to-equity ratio.

If you don't have your total liabilities and equity on-hand, use this calculator to calculate your restaurant debt-to-equity ratio.

A Breakdown of Total Liabilities and Total Equity

Total Liabilities = Current Liabilities + Long Term Liabilities

- Current Liabilities: Any debts that need to be paid in the next year. For example: short-term loans, taxes payable, unpaid wages, and other accounts payable.

- Long-Term Liabilities: Any debts/obligations that will need to be paid after the next year. For example: long-term loans and long-term mortgages.

Total Equity = Contributed Capital + Retained Earnings

- Contributed Capital: All investments made in the business; for example, stocks.

- Retained Earnings: Profit of a firm after accounting for dividends.

Debt-to-Equity Ratio Example

Danny owns an Italian restaurant. He has just taken on a $10,000 long-term loan to help him pay for additional equipment he needed for the kitchen. He has $1,000 of inventory on credit and $1,000 of wages earned.

|

|

|

Inventory on credit: $1,000 | Long-term loan: $10,000 | $12,000 |

Danny’s father, Joe, personally invested $40,000 into the restaurant business to help Danny get started. Danny’s net income is $10,000. Joe decides he will not collect dividends yet on the net income since Danny is just starting off. Because no dividends are yet owed, Danny’s net income is equal to his retained earnings.

|

|

|

|

|

|

Taking our equation from before:

Total Liabilities / Total Equity = Debt-to-Equity Ratio

12,000/50,000 = Debt-to-Equity Ratio = .24

If any of these calculations on total equity or total liabilities are not clear, check out our restaurant metrics calculator for more help.

What Debt-to-Equity Ratio is Typical for the Restaurant Industry?

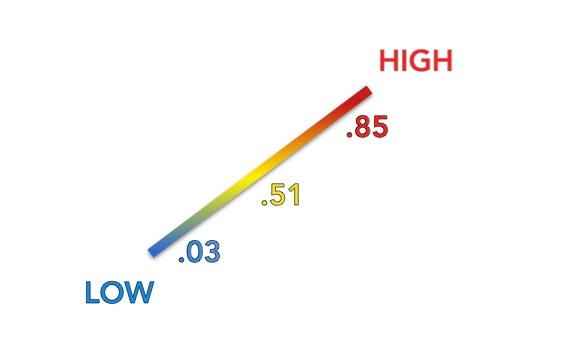

There is typically a range of ideal debt-to-equity ratios. This ideal range varies depending on what industry your business is in. According to data from 2018 about the restaurant industry, 0.85 is considered to be a high debt-to-equity ratio, while 0.56 was considered to be average, and 0.03 was considered to be low.

There are certain disadvantages that come with having too high of a debt-to-equity ratio.

This means that you have a high risk of being unable to pay your loans/debt (otherwise known as defaulting). As your debt-to-equity ratio increases, so does this risk.

With a high debt to equity ratio, you may have trouble finding additional funding, as banks will not likely give you additional loans.

Is your debt-to-equity ratio too low?

Remember, having some debt is not always a bad thing.

Debt is much less expensive than equity for funding your business' growth in the long run. Once debt is paid off, it’s a done deal.

Conversely, equity or stock owned by investors will continue to take shares of profits (in the form of dividends) unless they decide to sell their stock. Having a low debt-to equity ratio is by no means a problem for you though, and you will have an easy time getting a loan if you ever desired one to grow your business.

Final Thoughts

Debt to Equity Ratio is a key metric that you – and any investors – should use to help determine the health of your business.

Taking on too much debt can prevent your business from being able to secure additional funding and can be risky as you may be unable to pay the additional loans back, thereby defaulting.

While too much debt is a bad thing, some loans can serve as a relatively inexpensive means of funding the growth of your business.

Is this article helpful?

DISCLAIMER: This information is provided for general informational purposes only, and publication does not constitute an endorsement. Toast does not warrant the accuracy or completeness of any information, text, graphics, links, or other items contained within this content. Toast does not guarantee you will achieve any specific results if you follow any advice herein. It may be advisable for you to consult with a professional such as a lawyer, accountant, or business advisor for advice specific to your situation.

Read More

Subscribe to On the Line

Sign up to get industry intel, advice, tools, and honest takes from real people tackling their restaurants’ greatest challenges.