What’s The Difference Between A W4 vs. A W2

There are several forms used by employees and employers for tax purposes. Avoid confusion and learn about the key differences of Forms W-2, W-4, and W-9 in this article.

Tessa ZuluagaAuthor

Restaurant Budget Template

Use this template to make sure your projections are accurate and help eliminate overspending across your business.

Get free downloadThis article was subject-matter approved by Dave Emmerman, who leads the Enterprise Accounts team at Xero.

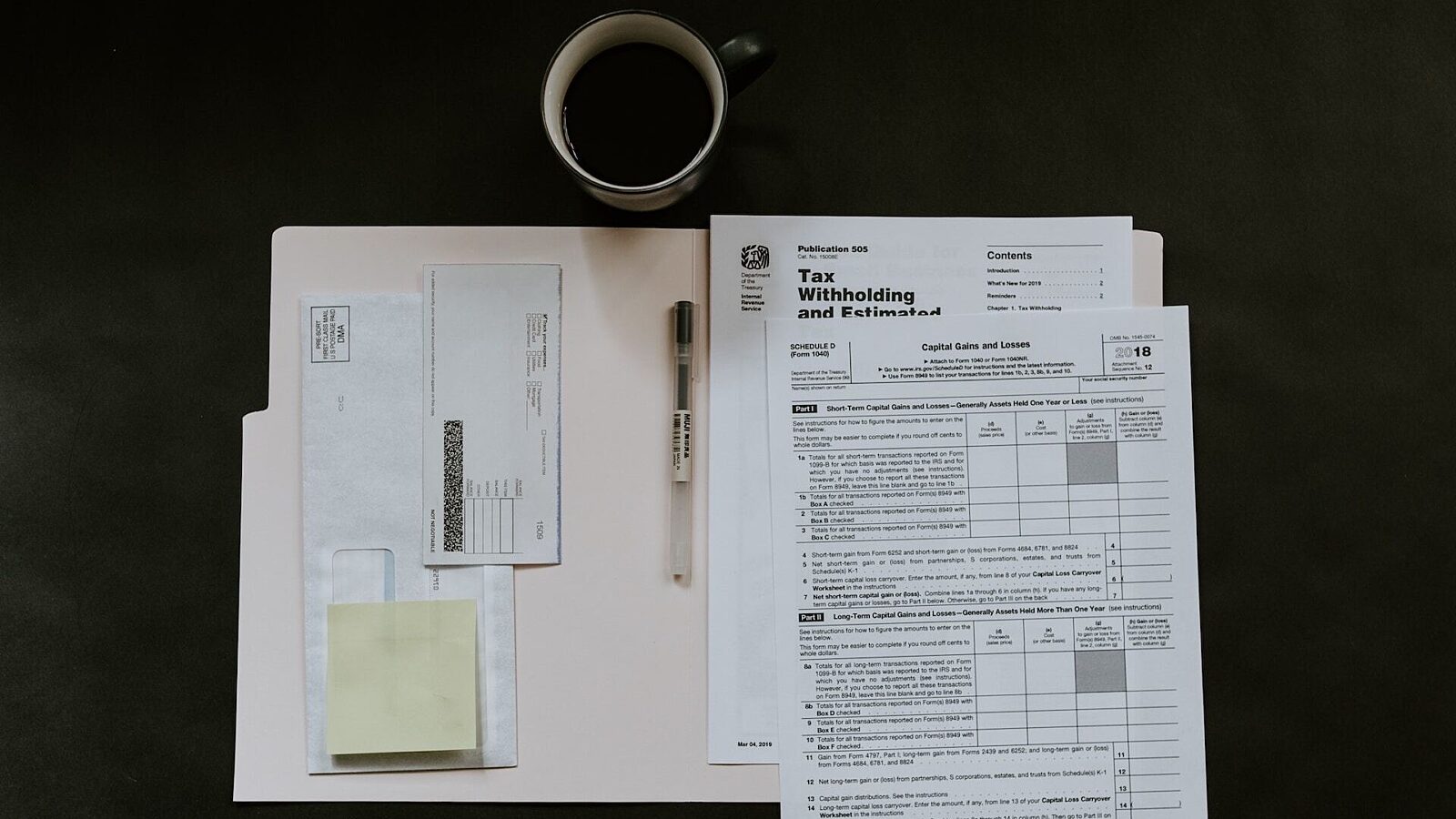

It can be confusing to differentiate between tax forms – especially ones that sound so similar. Understanding the differences between W-2 and W-4 forms, who completes them, and where to find them is an important part of payroll operations. Take a look at these different forms and how they are used for payroll.

In this article, we’ll discuss what W-2, W-4, and W-9 forms are and how to compare them.

This content is for informational purposes and is not intended as legal, tax, HR or any other professional advice. Please contact an attorney or other professional for specific advice based on your unique circumstances.

Par Inventory Sheet Template

Seamlessly track inventory with the help of this customizable par inventory sheet template.

Why tax documents are important for restaurants

Understanding different tax forms for payroll is essential for restaurant operators to ensure legal compliance, accurate financial management, and positive employee relations. Having educated managers to communicate with new hires is crucial. Understanding these forms is a helpful step in restaurant managers being able to comply with tax regulations, accurately withhold taxes from employees' paychecks, and answer employee questions.

This knowledge may also allow certain businesses to take advantage of available tax credits and deductions. Additionally, understanding these forms aids in maintaining precise records and offering attractive employee benefits, contributing significantly to the overall success and stability of your restaurant business.

For more information on additional IRS tax forms check out the IRS website here.

What is a W-2 Form?

A W-2 tax form reports an employee’s earnings for the year and records the amount of federal, state, and other taxes withheld from employees’ pay. It is used to file federal and state taxes. It also contains important information such as employer identification number, social security number, and other personal information. As an employee, the accuracy of the information on your W-2 is critical when preparing to file your tax return.

W-2 forms are generated by the employer or payroll administrator. If you used Toast Payroll during a tax year, Toast generates W-2 forms unless a separate payroll provider was used later in that year. W-2s will be available for employers to distribute to employees on January 19th, 2024.

Restaurant Cost Control Guide

Use this guide to learn more about your restaurant costs, how to track them, and steps you can take to help maximize your profitability.

What is a W-4 Form?

The W-4 is a form an employee completes to indicate how much in taxes they want withheld from their pay. When starting a new job, employees are required to fill out a W-4 form and submit it to their employer. The form includes several worksheets to help employees calculate the number of allowances they can claim. The allowances an employee claims affect the amount of tax withheld. The more allowances an employee claims, the less tax will be withheld from their paycheck, and vice versa.

The W-4 tax form tells Toast Payroll, for example, how much in taxes to withhold from an employee's check. To learn more about federal and state income tax calculations, click here.

If you’re an employee on Toast Payroll, you may access your W-4 by navigating to My Profile > Documents & Forms > Tax Forms tab. At the bottom, select either the hyperlinked federal W-4 or the Fill Out State W-4 button and make the appropriate changes. These will take effect on the next payroll.

As an employer on Toast Payroll, navigate to the employee's profile and select the Taxes & Documents tab > Tax Forms tab. By selecting the Edit button, you may make elections on behalf of the employee if they have permitted you to do so. Click here for more information.

What is a W-9 Form?

According to the IRS, individuals should use Form W-9 to provide their Taxpayer Identification Number (TIN) to the person who is required to file an information return with the IRS to report, for example:

Income paid to you

Real estate transactions

Mortgage interest you paid

Acquisition or abandonment of secured property

Cancellation of debt

Contributions you made to an IRA

Locate the W-9 form by navigating to the contractor's profile and selecting the Taxes & Documents tab > Tax Forms page. The W-9 contains information such as an individual name, whether or not they are operating a business, and their tax classification. One may have to create or request a taxpayer identification number in order to fill out the form.

Comparing Forms W-2, W-4, and W-9

An employee uses a W-4 to inform their employer how much tax to withhold from their earned income. Then at the end of the year, a W-2 will report year-end earnings. The employer provides the W-2 to the employee. This includes information on how much was taken out of the employee’s gross pay for withholdings, such as federal, state, and local taxes.

When comparing the W-4 vs W-9 forms, the difference is that an employee fills out a W-4 while an independent contractor fills out a W-9.

Toast Payroll

Now that you have a better understanding of tax withholding and other payroll taxes- where do you go from here? It depends. Are you ready to speed up employee onboarding, simplify payroll, and ensure your team is paid on time? Toast Payroll & Team Management can save you time and money so you can focus on what matters, delighting your guests and staff. Start onboarding without the headache today.

For more information on payroll check out this article, How to Do Payroll for Restaurants.

Is this article helpful?

DISCLAIMER: This information is provided for general informational purposes only, and publication does not constitute an endorsement. Toast does not warrant the accuracy or completeness of any information, text, graphics, links, or other items contained within this content. Toast does not guarantee you will achieve any specific results if you follow any advice herein. It may be advisable for you to consult with a professional such as a lawyer, accountant, or business advisor for advice specific to your situation.

Read More

Subscribe to On the Line

Sign up to get industry intel, advice, tools, and honest takes from real people tackling their restaurants’ greatest challenges.